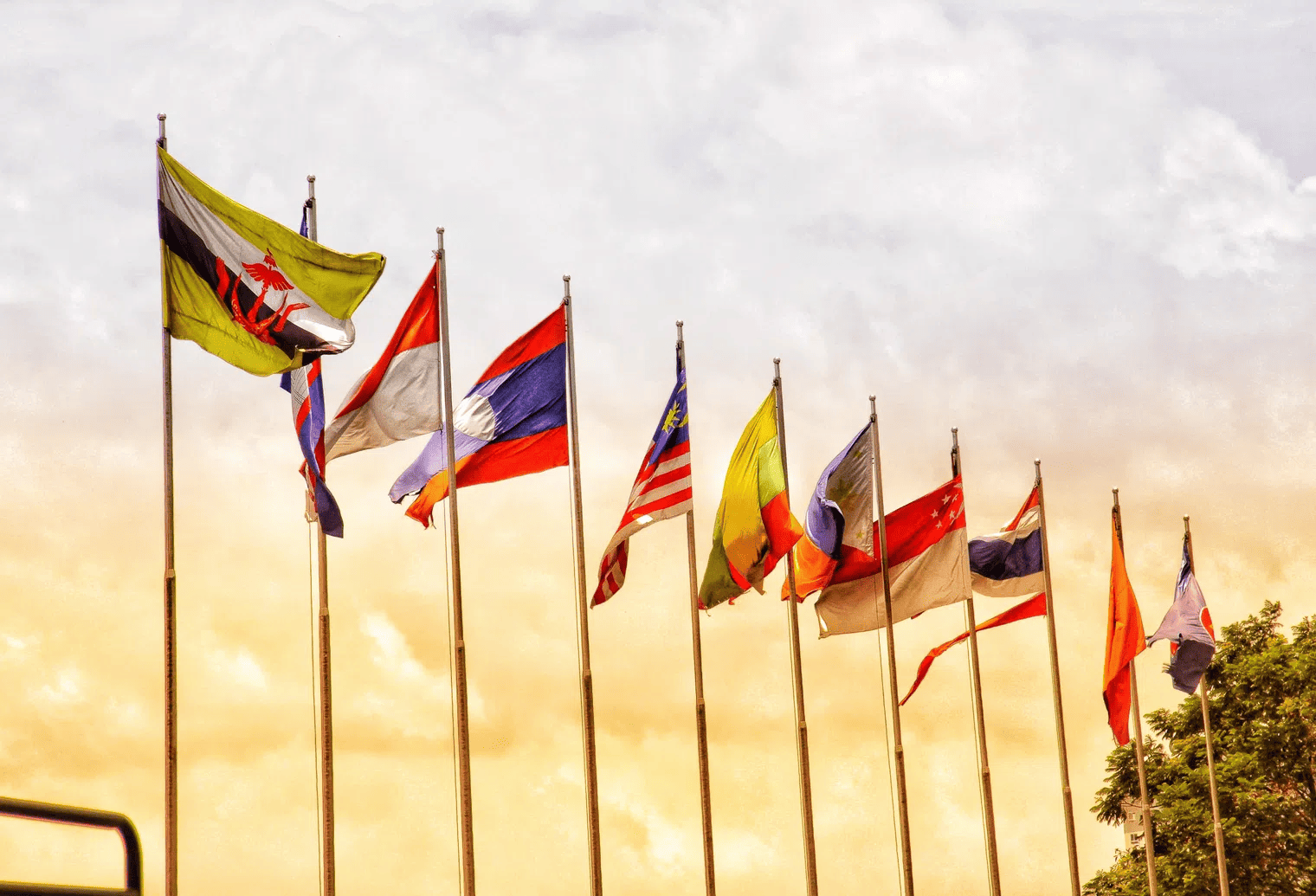

KUALA LUMPUR – Malaysia is taking up the Asean chairmanship for 2025 against a backdrop of heightened diplomatic activity that has raised expectations of what Prime Minister Anwar Ibrahim’s government can achieve heading the usually less-than-dynamic South-east Asian bloc.

The premier has had a busy travel schedule in the two years since he was sworn in after Malaysia’s first-ever hung Parliament in November 2022, and has been vocal over a raft of geopolitical issues, many of which have played well to the domestic gallery.

The pace of his international work is set to continue as 2024 draws to a close, as he embarks on a South America tour in mid-November for the Asia-Pacific Economic Cooperation forum and Group of 20 summit, while also squeezing in a visit to Beijing – his third since March 2023.

This is after deciding to skip in October the Brics Summit in Kazan, Russia, and the Commonwealth Heads of Government Meeting in Samoa.

“One thing’s for sure, Malaysia wants to make sure this is the best ever chairmanship,” Professor Sufian Jusoh, Institute of Malaysia and International Studies (Ikmas) professor of international trade and investment, told The Straits Times.

He added that Datuk Seri Anwar “will probably try to address the most difficult elephant in the room, which is (the) Myanmar (crisis)”.

Officials have been bullish, according to diplomatic sources, about making great strides in 2025 ever since the Asean summit earlier in October, which culminated in the ceremonial handover of the chair from Laos to Malaysia.

“This is not an incoming train but the end of the tunnel,” Malaysia’s Foreign Minister Mohamad Hasan said of the Myanmar crisis on Oct 22 after unveiling the logo and theme – inclusivity and sustainability – for Asean 2025.

But little progress has been made by the military junta to achieve Asean’s five-point consensus since it was agreed upon in 2021. Nearly 6,000 people have been killed and 30,000 imprisoned in the war-torn country. A third of the 55 million population is in need of humanitarian aid as at August.

Failure to stop the violence and start a dialogue between all parties mediated by an Asean envoy with access to all stakeholders, along with allowing in adequate humanitarian aid, has seen Myanmar’s military chief Min Aung Hlaing barred from the bloc’s meetings since October 2021.

Institute of Strategic and International Studies senior fellow Thomas Daniel told ST: “There are heightened expectations due to past statements, but Anwar has been more circumspect on Myanmar.”

A pragmatic outcome, he said, would be to get the junta “to agree to meet Asean halfway” on the five-point consensus and allow a “formal consultation with a wide range of anti-coup stakeholders”, which would mean allowing access to political detainees.

More so than the worsening Myanmar crisis, Malaysia’s chairmanship will be closely watched on Asean’s other key challenge: the prolonged dispute in the South China Sea, given a growing closeness between the Anwar administration and Beijing.

However, Asean’s long-held stance of non-interference in the internal affairs of its members, and a steadfast commitment to acting only on consensus, continues to be a stumbling block to swift progress on both the Myanmar and China situations.

Professor Kamarulnizam Abdullah, principal fellow and founding head of Ikmas, told ST: “People who look from that perspective... of quick answers, Asean doesn’t work like that.”

Ikmas is a “knowledge partner” for Malaysia’s Asean chairmanship, with the government having consultations with the institute and potentially taking suggestions on board.

He said the so-called Asean way of non-interference and consensus-building has won respect from Beijing “because China is also relying on Asean as a conduit to the West”.

But the game of optics and perception in diplomacy can often be a double-edged sword.

While Mr Anwar’s huge investment into building trust with China may help move things forward on the issue of disputed waterways – especially given the increasing tensions between Beijing and Manila – murmurs are growing over whether Malaysia can be an honest broker between China and Asean, given the extent of Kuala Lumpur’s tilt away from the West.

This can be seen not just in Malaysia’s fulsome support of Palestine and inviting Russian President Vladimir Putin to the 2025 Asean summit, but also Prime Minister Anwar’s effusive praise of President Xi Jinping and condemnation of “China-phobia”.

While some observers see nothing more than self-interest in Malaysia engaging with its top trade partner, diplomats, as well as think-tanks, are far more concerned over how having closer ties with China may erode trust in any attempt by Kuala Lumpur to accelerate a South China Sea resolution.

This might be compounded by Beijing wanting to make progress on a South China Sea Code of Conduct (COC) between Asean and China before the Philippines takes over chairmanship of the bloc in 2026. The territorial claims between Manila and Beijing have escalated into violence, with accusations of boat-ramming being hurled in both directions.

But Dr Ngeow Chow Bing, director of Universiti of Malaya’s Institute of China Studies, believes the obstacles to a COC are more structural.

“There are the often highlighted issues about whether parties external to Asean and China should play a role, and also on dispute settlement mechanisms. But the most crucial is geographical scope,” he told ST.

China would like the COC to apply to its so-called nine-dash line, while Malaysia, for instance, would say the COC should apply only outside of waters it claims absolute sovereignty over, and the Philippines would exclude territories already awarded to Manila through international arbitration.

But to show tangible progress, it is likely that agreement on certain paragraphs and clauses in the COC will be finalised while leaving more contentious sections for the future.

In its role as Asean chair, Malaysia will likely see more success on economic or socio-cultural pillars, such as upgrading relations with the Gulf Cooperation Council countries in the Middle East to include economic discussions.

Deputy Investment, Trade and Industry Minister Liew Chin Tong said on Oct 29: “For the first time, we are thinking of a new way of seeing the world, where we (Asean) are at the centre linking Gulf countries and China.”

Source: The Straits Times

Link:

Here